Towards A Better Tomorrow

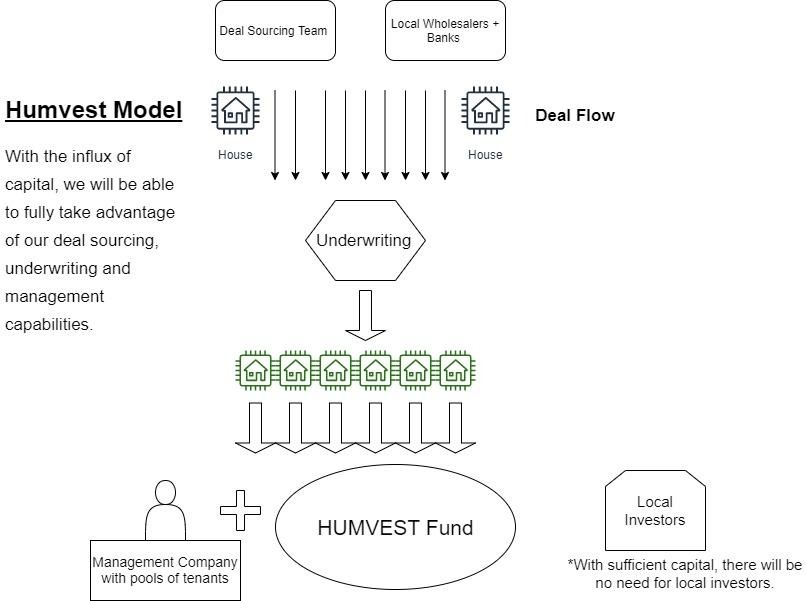

*Due to the high volume of homes that pass through our deal sourcing team, we have reached our current capacity of investment homes we can purchase. The overflow is sold to our local investors.

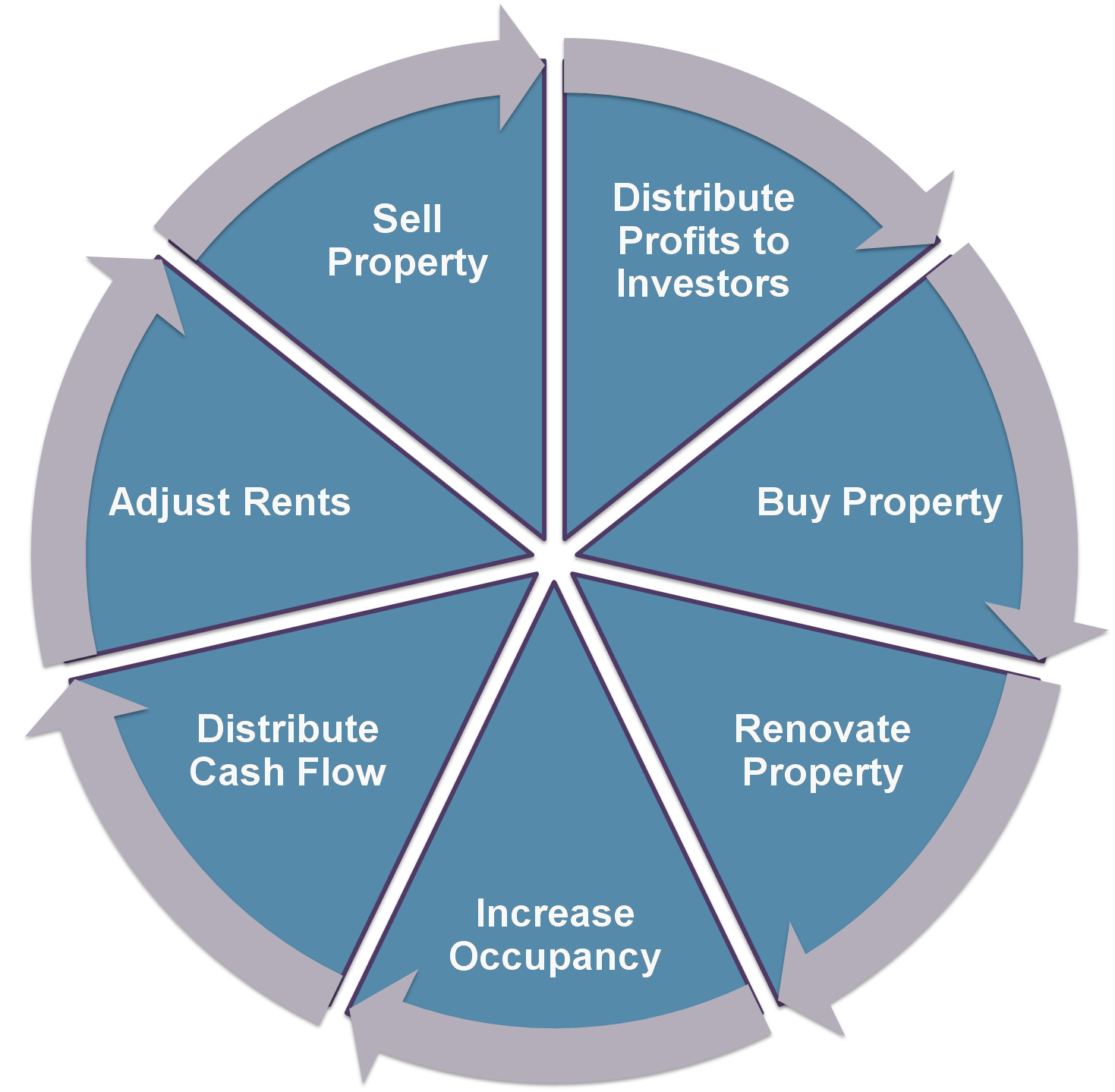

With Humvest Fund, we are able to utilize the full force of our deal sourcing team, coupled with our stringent underwriting and management. Having priority access lets us cherry-pick the investments that work best for us.

Extreme Supply Demand Imbalance

The U.S. built on average 276,000 fewer homes per year between 2001 and 2020.

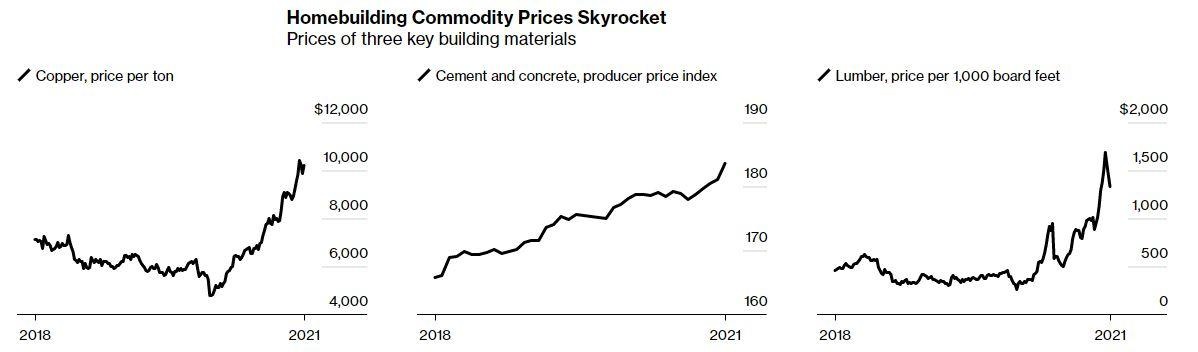

From wood to paint, construction costs have risen significantly.

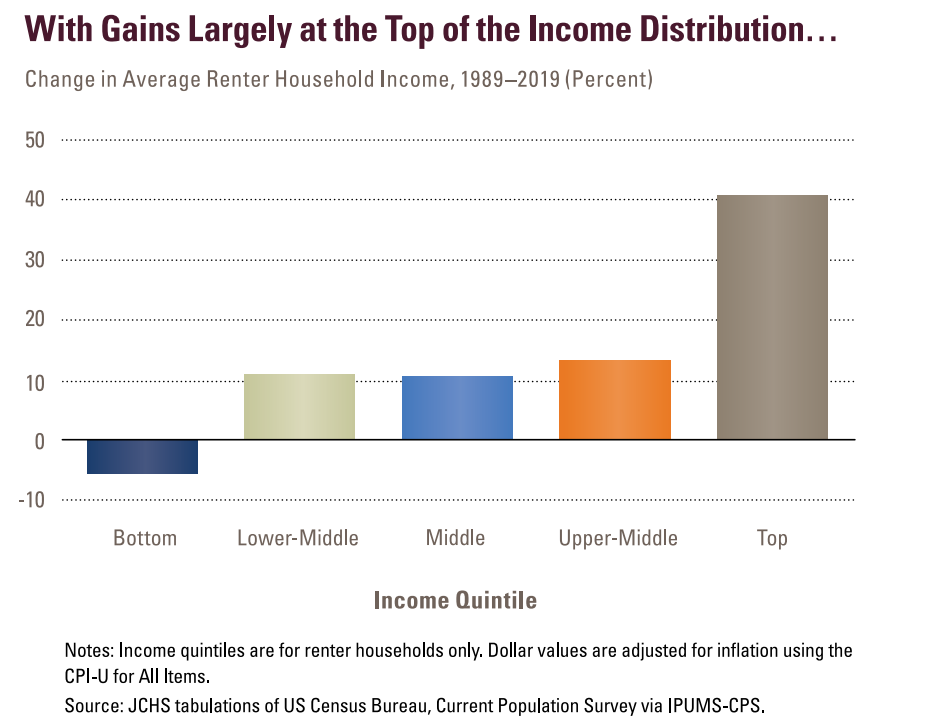

Average real income of the top fifth of renters rose by >40%.

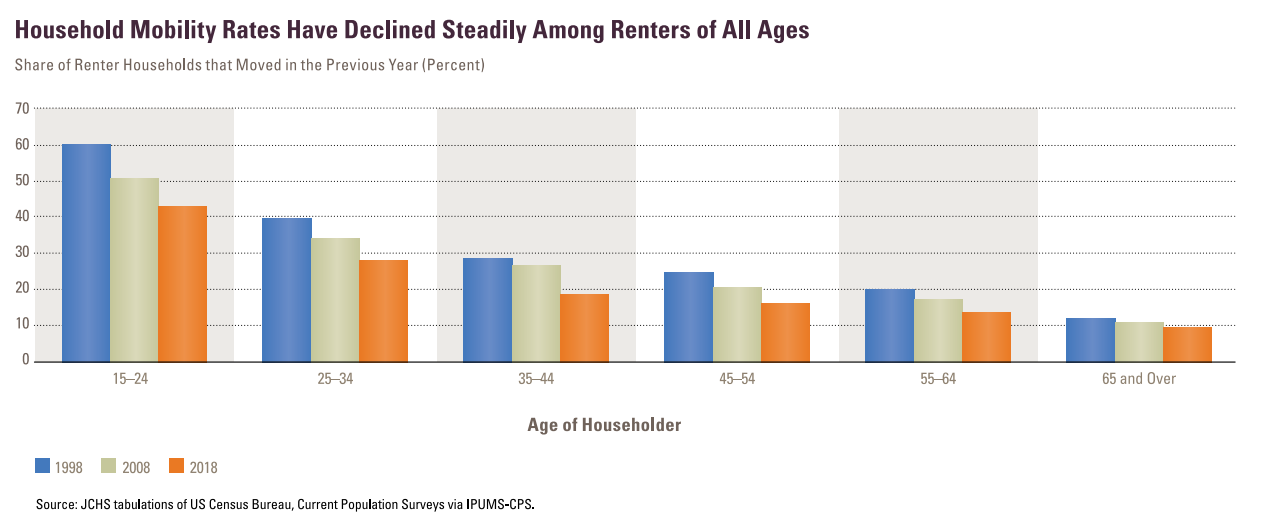

Average rental period before ownership has increased from 2.3 years to 9 years.

With our exclusive network of brokers, banks and local sellers. We average around 6-12% discount on all properties we acquire.

We leverage favorable terms. Historically, we have secured rates as favorable as 4.25% fixed with a 75% LTV.

With our hands-on approach for qualifying tenants and upkeep, we have average rents 5-10% higher than the market average.

We get priority access to homes before they are listed, allowing us to purchase well below market value (CMA).

| Address | Town | Zip | Purchase Date | Purchase Price | CMA (Value) |

|---|---|---|---|---|---|

| 53 Wyckoff Ave | Hicksville | 11801 | 2/12/21 | $471,000 | $530,000 |

| 295 W 24th St | Deer Park | 11729 | 3/22/21 | $325,000 | $510,000 |

| 450 Clayton St | Central Islip | 11722 | 5/10/21 | $235,000 | $410,000 |

| 97 Lee Ave | Hicksville | 11801 | 5/18/21 | $550,000 | $650,000 |

| 14 East Ave | Hicksville | 11801 | 6/3/21 | $510,000 | $540,000 |

| 55 Railroad St | Huntington Station | 11746 | 6/3/21 | $315,000 | $400,000 |

| 3 Jordan Ln | Hicksville | 11801 | 6/14/21 | $480,000 | $540,000 |

| 8 Kelsey | Huntington Station | 11746 | 6/30/21 | $332,500 | $400,000 |

| 39 Bay Ave | Hicksville | 11801 | UC 8/9 | $455,000 | $510,000 |

Raise Amount

Length

Target IRR

Founders and management have been investing their own capital in RE since 1998 totaling over $100 M

INVEST WITH US